Renters Insurance in and around Palm Bay

Palm Bay renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

There's a lot to think about when it comes to renting a home - size, number of bedrooms, price, townhome or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Palm Bay renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Why Renters In Palm Bay Choose State Farm

The unanticipated happens. Unfortunately, the stuff in your rented property, such as a tool set, a TV and a set of favorite books, aren't immune to break-in or fire. Your good neighbor, agent Weston Johnson, is passionate about helping you choose the right policy and find the right insurance options to protect your personal posessions.

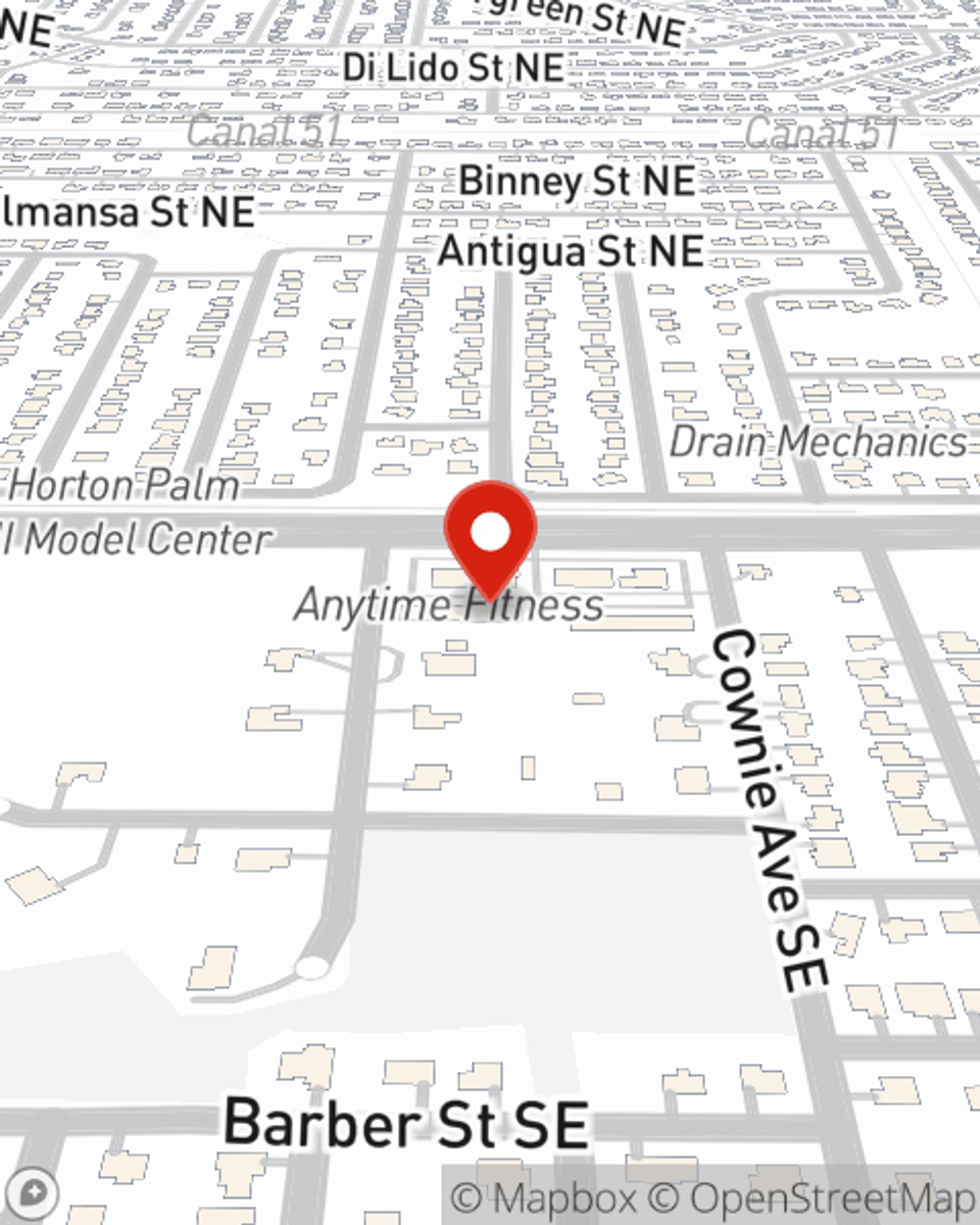

Reach out to State Farm Agent Weston Johnson today to learn more about how a State Farm policy can protect items in your home here in Palm Bay, FL.

Have More Questions About Renters Insurance?

Call Weston at (321) 541-1433 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Weston Johnson

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.